Meta Description: Stuck choosing a debt repayment method? We compare the debt avalanche and debt snowball strategies side-by-side, with clear examples and a quiz to help you pick the right plan for your personality and finances.

If you’re carrying multiple debts, you know the burden they create—not just financially, but emotionally. The path to becoming debt-free requires a clear strategy. Two of the most popular and effective methods are the debt avalanche and the debt snowball. While both will eliminate your debt, they work in fundamentally different ways. This guide will break down each method, provide a clear comparison, and help you decide which one aligns with your psychology and financial situation for lasting success.

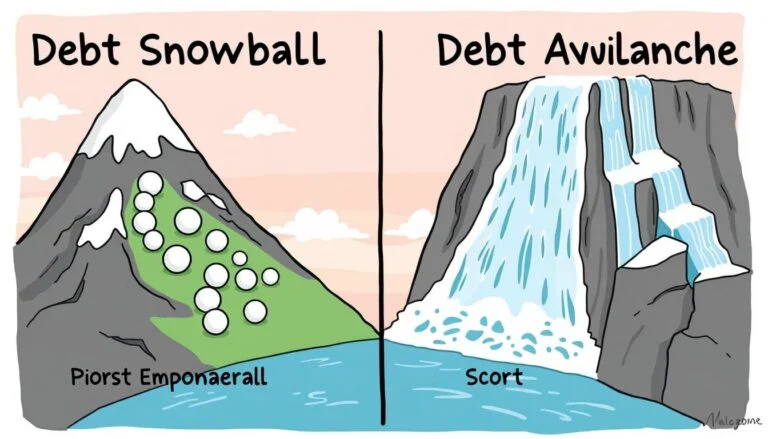

What is the Debt Avalanche Method? (The Mathematically Optimal Choice)

The debt avalanche is a numbers-first strategy. You list all your debts from the highest interest rate to the lowest. You make minimum payments on every debt, but you throw every extra dollar you can find at the debt with the highest interest rate. Once that debt is gone, you take its payment and “avalanche” it onto the debt with the next highest rate.

Example:

You have a $5,000 credit card at 22% APR, a $10,000 personal loan at 6% APR, and a $20,000 student loan at 4% APR. With the avalanche, you attack the credit card first, regardless of its balance.

Pros:

- Saves the most money on interest over the repayment period.

- Gets you out of debt fastest (in terms of total months) because you eliminate costly interest first.

- Financially efficient.

Cons:

- Can feel slow to gain momentum, especially if your highest-rate debt has a large balance.

- Requires strong discipline without early psychological wins.

What is the Debt Snowball Method? (The Behaviorally Powerful Choice)

The debt snowball, popularized by personal finance expert Dave Ramsey, prioritizes psychology over math. You list all your debts from the smallest balance to the largest, regardless of interest rate. You make minimum payments on everything, but put all extra cash toward the smallest debt first. When it’s paid off, you celebrate the win, then roll its payment amount onto the next smallest debt, creating a growing “snowball” of payments.

Example:

Using the same debts: You’d pay off the $5,000 credit card first (if it’s the smallest), then the $10,000 loan, then the $20,000 student loan—even if the student loan has a higher rate than the personal loan.

Pros:

- Provides quick wins and psychological momentum. Crossing debts off your list is highly motivating.

- Simplifies your number of accounts faster, reducing mental overhead.

- Builds confidence and reinforces the debt-repayment habit.

Cons:

- You will pay more in total interest over time.

- The process may take longer overall than the avalanche.

Side-by-Side Comparison: Avalanche vs. Snowball

| Feature | Debt Avalanche | Debt Snowball |

|---|---|---|

| Primary Logic | Mathematical | Psychological |

| Debt Order | Highest Interest Rate → Lowest | Smallest Balance → Largest |

| Total Interest Paid | Lower | Higher |

| Time to Debt-Free | Faster (mathematically) | Potentially Slower |

| Early Motivation | Can be slow | High (quick wins) |

| Best For | The disciplined, numbers-focused person who is motivated by efficiency. | The person who needs momentum and visible progress to stay on track. |

How to Choose: A Simple Quiz

Ask yourself these questions:

- Are you motivated more by numbers or by checking items off a list?

(Numbers = Avalanche | Checklist = Snowball) - Do you have one debt with a much higher interest rate than the others?

(Yes = Lean Avalanche | No = Consider Snowball) - Have you started and stopped budgeting or debt plans before?

(Yes = Likely Snowball | No = You might handle Avalanche) - Is the difference in total interest between the two methods significant?

Run the numbers. Use a free online calculator. If the avalanche saves you thousands, it’s worth strong consideration. If the difference is minor (a few hundred dollars), the snowball’s motivational benefit may be worth the cost.

The Hybrid Approach: You don’t have to be purist. One effective strategy is to use the snowball to build momentum on small debts first, then switch to the avalanche for the remaining larger balances. This can offer the best of both worlds.

Your Action Plan: Getting Started Today

- List All Debts: For each, note the creditor, total balance, minimum payment, and interest rate.

- Choose Your Method: Based on your quiz answers and personal tendencies.

- Order Your Debts: Either by interest rate (Avalanche) or balance (Snowball).

- Create a Bare-Bones Budget: Find every extra dollar to put toward your target debt.

- Automate & Attack: Set up minimum payments on autopilot and manually (or automatically) send your “extra” payment to your chosen target debt each month.

The Bottom Line: The best debt repayment strategy is the one you will stick with. If the avalanche demoralizes you and you quit, it saves you $0. If the snowball keeps you engaged and paying aggressively, it is the superior choice for you—even if the math isn’t perfect.

Choose the method that aligns with your personality, commit to it, and start today. Consistent action, powered by a plan you believe in, is what will ultimately lead you to a debt-free future.

Leave a Reply