Managing your money can feel overwhelming, but it doesn’t require a degree in finance—just a clear, structured plan. Whether you’re starting from scratch or looking to improve your current system, this step-by-step guide will help you take control of your finances, reduce stress, and work toward your financial goals with confidence.

Step 1: Assess Your Current Financial Situation

Before making any changes, you need a complete and honest understanding of where your money stands today. Gather your bank statements, bills, pay stubs, and any debt information. Calculate your total monthly income after taxes and list all your monthly expenses, including fixed costs (like rent, utilities, and loan payments) and variable spending (like groceries, dining out, and entertainment). Don’t forget annual or semi-annual expenses, such as insurance premiums or subscription renewals. This snapshot will show you exactly how much you earn, spend, and where you might be leaking cash.

Step 2: Set Clear Financial Goals

Once you know where your money is going, define where you want it to go. Set specific, measurable, and time-bound goals. Break them into short-term (within a year, like building a $1,000 emergency fund), medium-term (1–5 years, like saving for a car down payment), and long-term (5+ years, like retirement or buying a home). Having clear goals gives your financial plan purpose and makes it easier to stay motivated when making spending choices.

Step 3: Create a Realistic Budget

A budget is simply a plan for your income. Using the information from Step 1, allocate every dollar of your income toward a category: needs, wants, savings, and debt repayment. A popular and flexible method is the 50/30/20 rule:

- 50% for Needs: Essential expenses like housing, utilities, groceries, transportation, and minimum debt payments.

- 30% for Wants: Non-essentials like dining out, hobbies, travel, and entertainment.

- 20% for Savings & Extra Debt Payments: Building your emergency fund, contributing to retirement, and paying down debt faster.

Adjust these percentages to fit your income and priorities. The goal is to ensure your spending aligns with your goals.

Step 4: Build and Protect with an Emergency Fund

Life is unpredictable. An emergency fund acts as a financial safety net for unexpected expenses like car repairs, medical bills, or job loss. Aim to save 3–6 months’ worth of essential living expenses. Start small—even $500 can buffer against minor surprises—and build consistently. Keep this money in a separate, easily accessible account, like a high-yield savings account, to avoid temptation and earn some interest.

Step 5: Tackle High-Interest Debt Strategically

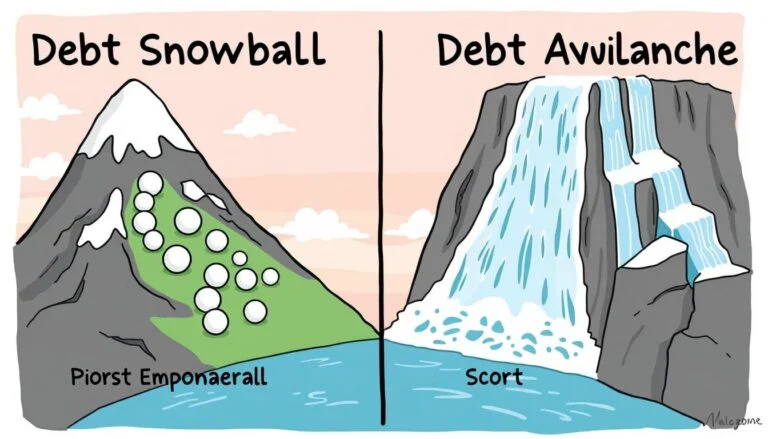

High-interest debt, especially from credit cards, can derail financial progress. After establishing a starter emergency fund, focus on paying down these costly balances. Two effective methods are:

- Debt Avalanche: Pay minimums on all debts, but put any extra money toward the debt with the highest interest rate first. This method saves the most on interest over time.

- Debt Snowball: Pay minimums on all debts, but put extra money toward the smallest balance first. The quick wins can boost motivation.

Choose the strategy that best fits your personality and stick with it.

Step 6: Automate Your Finances

Automation is the secret to consistency. Set up automatic transfers to move money to your savings and investment accounts as soon as you get paid. Use autopay for bills to avoid late fees. Automating “paying yourself first” and essential bills ensures you prioritize your goals and reduces the mental load of money management.

Step 7: Review and Adjust Regularly

Your financial plan is not set in stone. Life changes, and so should your budget. Schedule a monthly money check-in to review your spending, track progress toward your goals, and adjust categories as needed. This regular review keeps you engaged, helps you catch problems early, and allows you to celebrate your progress.

Conclusion: You’re in Control

Managing your money is an ongoing practice, not a one-time task. By following these steps—assessing, goal-setting, budgeting, saving, debt-reducing, automating, and reviewing—you build a system that works for you. Financial peace comes from having a plan and taking consistent, small actions. Start with one step today. Your future self will thank you.

Leave a Reply